would record a change only if it sold some of its stake in Sub Co., resulting in a Realized Gain or Loss. Unrealized Gains and Losses on Equity Investments do not appear directly on the Income Statement, so even if Sub Co.’s Market Cap increased to $1 billion or fell to $10 million, nothing would change. However, that assumption does not matter as long as the initial 30% stake also stays the same. We assume here that Sub Co.’s Market Cap stays constant at $100 million throughout this period. Here’s the Income Statement for Years 1 – 5: It funds this purchase of the 30% stake with 50% Cash and 50% Debt.

owns no stake in Sub Co., and at the end of Year 2, it acquires a 30% stake in Sub Co., when Sub Co.’s Market Cap is $100 million. It’s about 10x the size of Sub Co., which has $40 million in revenue, growing to $60 million in the same period. has $400 million in revenue, growing to $600 million in Year 5.

LIBRE CALC BOOKKEEPING BOOKS FOR BEGINNERS FULL

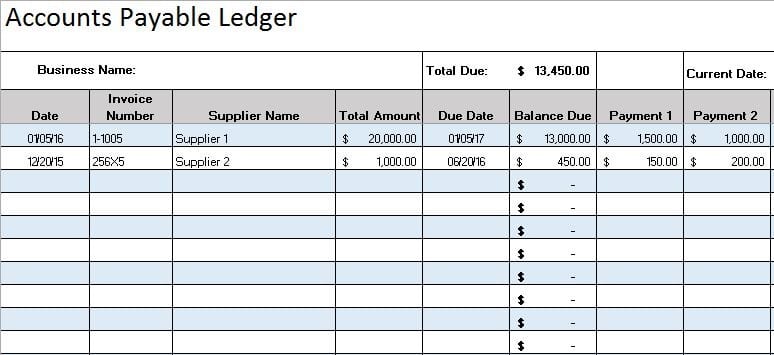

If you want to go beyond that bare minimum, here’s the full set of steps in the equity method: Equity Method of Accounting Example, Part 1: Purchasing a Minority Stake and Recording Net Income and Dividends from It Therefore, you must subtract Equity Investments so that the numerator, Enterprise Value, and the denominator of valuation multiples ( EBIT or EBITDA) ignore Equity Investments. You subtract this “Equity Investments” line item when calculating Enterprise Value because it counts as a non-core-business asset.Īlso, as you can see from the screenshot above, metrics like EBIT and EBITDA completely exclude contributions from Equity Investments.īut Equity Value reflects the value of Net Assets to Common Shareholders, so it includes these Equity Investments. On the Balance Sheet, the “Equity Investments” line item on the Assets side represents the Parent’s minority stake in this Sub Co.īoth Cash Flow Statement line items link into Equity Investments: Equity Investment Earnings increases it, and the Ownership Percentage * Sub Co.’s Dividends reduces it. reverses this “Equity Investment Earnings” line item on its Cash Flow Statement and records its Ownership Percentage * Sub Co.’s Dividends as a positive on its CFS. Here’s a simple example of the Income Statement for a Parent Company with a 30% stake in a Sub Co.: records its Ownership Percentage * Sub Co.’s Net Income on its Income Statement under “Equity Investment Earnings,” or a similar name.īut it records nothing else from Sub Co., so the financial statements are not consolidated. learn more The Bare Minimum You Must Know About the Equity Method of Accounting Learn Excel & VBA, accounting, valuation, financial modeling, and PowerPoint for investment banking and private equity - and save $194 with our most popular course bundle. To get this article in video format, take a look at the YouTube example from our channel and the Excel example below: You need to know about it because you’ll work with companies that list Equity Investments, Associate Companies, and Joint Ventures on their Balance Sheets. That said, the equity method of accounting is still more of an on-the-job issue. Equity Value? What about valuation/DCF analysis? How do Equity Investments or Associate Companies factor into Enterprise Value vs.Explain the flow of Net Income and Dividends when a Parent Company owns 20% or 30% of a Subsidiary Company.What is the equity method? When do you use it?.However, it can come up, especially if you’re in an industry or region where joint ventures and partnerships are common, or if you have more work experience. The equity method of accounting is not a “common” interview topic. Why Does This Matter? Is the Equity Method a Common Interview Topic? You can see many examples of this accounting method in real life if you look through press releases and financial statements: They all relate to the same concept the “equity method of accounting” is the process, and the “equity investments” or “associate companies” are the line items created on the Balance Sheet. You’ll also see the names “equity investments” and “associate companies” used to refer to these partial stakes. That’s a separate and more complicated topic, so we’re going to focus on just the equity method here. When the stake is greater than or equal to 50% but less than 100%, consolidation accounting, which creates a Noncontrolling Interest, is used. In practice, that means “an ownership stake between 20% and 50% in another company,” though some companies also use it for stakes below 20%. The equity method is used when one company has “significant influence,” but not control, over another company.

When it comes to confusing accounting topics, partial stakes in other companies and the equity method of accounting consistently rank near the top of the list.

0 kommentar(er)

0 kommentar(er)